- Home

- Policy Issues

- Debt policy

- Overview

- State Debt and State-guaranteed Debt

State Debt and State-guaranteed Debt

-

About Ministry

- Recruitment

-

Accountable agencies

-

State Enterprises and Institutions Belonging to the Sphere of Management of the Ministry

- State enterprise "Management for the operation of the property complex"

- SERVICE AND PUBLISHING CENTR

- Central Treasury sample control enterprise

- Eastern state-owned enterprise of sampling control

- Western state-owned enterprise screening control

- Southern state enterprise of sampling control

- Dnipropetrovsk state-owned enterprise of sampling control

- State enterprise Kyiv offset factory

- State Service for Financial Monitoring

- State Treasury

- The State Audit Service of Ukraine

- State Tax Service of Ukraine

- State Customs Service of Ukraine

- Personnel Audit Procedures of State Customs Service

- State Tax University

-

State Enterprises and Institutions Belonging to the Sphere of Management of the Ministry

- Minfin Panel

-

Policy Issues

- Budget policy

- Tax Policy

-

Customs Policy

-

Integration of customs legislation into EU law

- Direct and indirect customs representation: possible scenarios for declaring goods and the role of a customs broker

- Customs representative and customs holder: who submits and signs documents

- Confirmation of the reliability of credentials for obtaining authorizations

- Authorization to carry out customs brokerage activities

- Integration of customs IT systems to MASP-C

-

Integration of customs legislation into EU law

-

Accounting and Auditing

-

Accounting

-

Introduction of International Financial Reporting Standards

- Translation of International Financial Reporting Standards 2025 (to be completed)

- Translation of international financial reporting standards of 2024

- Translation of international financial reporting standards of 2023

- Archive of translations

- Taxonomy

- Translation of technical publications

- General Clarifications (filled in after the preparation of the relevant letters of explanation)

- Accounting in Private Sector

- Accounting in the Public Sector

- Methodological Accounting Council under the Ministry of Finance of Ukraine (download a short description)

- IFRS Council under the Ministry of Finance of Ukraine (download a short description)

-

Introduction of International Financial Reporting Standards

- Auditing

- Sustainability reporting

-

Accounting

-

Debt policy

- Overview

- Debt News

- Debt Statistics

- Domestic Bonds

- Primary Dealers

- Eurobonds

- Credit Rating

- Investor Relations

- DMO Awards

- Anti-money laundering policy (AML)

- Financial Policy

- National revenue strategy

-

International Cooperation

-

Partners

- EU

- International Monetary Fund

-

Cooperation in Attracting Financing from the International Financial Institutions

- Development Bank of the Council of Europe

- Procedure for attracting funds of International Financial Institutions

- World Bank

- EBRD

- EIB

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH

- KFW

- Register of Joint IFIs Projects at the Stage of Preparation and Implementation (information)

- International Technical Assistance (within the competence of the Ministry of Finance)

- Monitoring of international technical assistance projects

- Cooperation with the Development Partners

- Ukraine Donor Platform

-

Partners

- International Tax Relations

- Development of Public Internal Financial Control (PIFC)

-

Public investment management

- Regulatory documents

- Implementation of the roadmap for reforming the management of public investments

- Interdepartmental Commission on the Distribution of Public Investments

- Unified portfolio of public investment projects (list of priority public investment projects)

- Interdepartmental working group on reforming the public investment management system

- Reference information

-

Other Areas of Public Policy

- Internal Audit

- Audit Committee of the Ministry of Finance of Ukraine

- Scientific and scientific and technical activity

- Reform Support Team at the Ministry of Finance of Ukraine

- Verification of State Social Payments

-

Fiscal Risks Managament

- Clarifications

- Legislation on Fiscal Risks Management

- List of Economic Entities with which Major Fiscal Risks May Be Related

- Reports

- List of business entities to which the Ministry of Finance approves proposals for individual financial indicators for the planning period, as well as proposals for maximum thresholds for the volume of capital investments

- Operations with precious stones and metals

- Licensing

- Public Finance Management Strategy (PFMS)

- Strategic Plan

-

Key Spending Unit - Ministry of Finance

- Budget Requests

- Passports of Budget Programs

- Evaluation of the Effectiveness of Budget Programs

- Procurement Reports

- Reports on the implementation of public investment projects

- Budget Information

- Information on the effectiveness of the use of public funds

- The structure and volume of budget funds under budget programs

- Cash Management

- Programs

-

Legislation

-

Regulatory Activity

- Regulatory Performance Tracking Reports 2026

- Activity plan of the Ministry of Finance of Ukraine for the preparation of draft regulatory acts in 2026.

- Schedule of measures in 2026 to track the effectiveness of regulatory acts of the Ministry of Finance of Ukraine

- Reports on tracking the effectiveness of regulatory acts in 2025.

- Activity plan of the Ministry of Finance of Ukraine for project preparation regulatory acts in 2025

- Plan-schedule of implementation of measures in 2025 regarding performance tracking regulatory acts of the Ministry of Finance of Ukraine

- reports_on_the_effectiveness_of_regulatory_acts_2024

- The activity plan for the preparation of the regulatory acts draft 2024

- Schedule of measures to monitor the effectiveness of regulatory acts 2024

- reports_on_the_effectiveness_of_regulatory_acts_2023

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2023

- Reports on the effectiveness of regulatory acts 2022

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2022

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2021

- Schedule of measures to monitor the effectiveness of regulatory acts 2021

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2020

- Schedule of measures to monitor the effectiveness of regulatory acts 2020

- Reports on the effectiveness of regulatory acts 2019

- The activity plan for the preparation of the regulatory acts draft 2019

- Schedule of measures to monitor the effectiveness of regulatory acts 2019

- Reports on the effectiveness of regulatory acts 2018

- The activity plan for the preparation of the regulatory acts draft 2018

- Schedule of measures to monitor the effectiveness of regulatory acts 2018

- Reports on the effectiveness of regulatory acts 2017

- The activity plan for the preparation of the regulatory acts draft 2017

- Schedule of measures to monitor the effectiveness of regulatory acts 2017

- Reports on the effectiveness of regulatory acts 2016

- The activity plan for the preparation of the regulatory acts draft 2016

- Schedule of measures to monitor the effectiveness of regulatory acts 2016

- Reports on the effectiveness of regulatory acts 2015

- The activity plan for the preparation of the regulatory acts draft 2015

-

Draft Regulatory Acts Discussion

- Draft regulatory acts for discussion in 2026

- Draft regulatory acts for discussion in 2025.

- Regulatory acts draft for discussion 2024

- Regulatory acts draft for discussion 2023

- Regulatory acts draft for discussion 2022

- Regulatory acts draft for discussion 2021

- Regulatory acts draft for discussion 2020

- Regulatory acts draft for discussion 2019

- Regulatory acts draft for discussion 2018

- Regulatory acts draft for discussion 2017

- Regulatory acts draft for discussion 2016

- Regulatory acts draft for discussion 2015

-

Draft Legislation

- Draft regulatory legal acts in 2026

- Draft normative legal acts in 2025.

- Legal acts drafts 2024

- Legal acts drafts 2023

- Legal acts drafts 2022

- Legal acts drafts 2021

- Legal acts drafts 2020

- Legal acts drafts 2019

- Legal acts drafts 2018

- Legal acts drafts 2017

- Legal acts drafts 2016

- Legal acts drafts 2015

-

Regulatory Activity

-

Data

- Cooperation with Civil Society

- Press Center

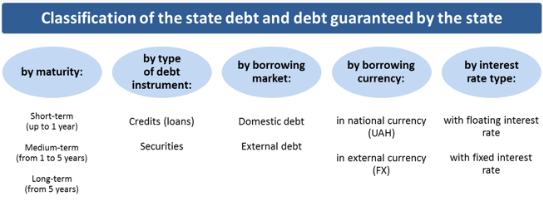

According to the Budget Code of Ukraine, state debt means the total amount of liabilities of the state on outstanding loans as at reporting date arising from the government borrowings.

State borrowings are carried out in order to cover the state budget deficit and to refinance state debt. The right to carry out state borrowings within limits defined by the State Budget Law of Ukraine belongs to the state represented by the Minister of Finance of Ukraine on behalf of the Cabinet of Ministers of Ukraine. The Cabinet of Ministers of Ukraine defines the underlying terms and conditions of state borrowings, including the basic terms of the loan agreements and the basic conditions of issuance and the procedure for the placement of government securities.

Loans from foreign states, banks, and international financial organizations for the implementation of investment projects are attracted by the state on the basis of international agreements and are reflected as external state borrowings.

Redemption and state service payments of the state debt are paid from the state budget under the loan agreements, as well as respective legal acts, regardless of the amount of funding set forth for such purpose by the law on the State Budget of Ukraine.

The Ministry of Finance of Ukraine is responsible for the management of state debt within the limits of the powers determined by the legislation of Ukraine. For the purpose of effective management of the state debt and/or liquidity of the single treasury account (STA), the Minister of Finance of Ukraine on behalf of Ukraine is entitled to execute transactions with public debt, including exchange, issue, purchase, repayment and sale of government debt, subject to compliance with the limit of state debt at the end of the budget period.

According to the Budget Code of Ukraine, state-guaranteed debt means the total amount of liabilities of Ukrainian resident business entities on outstanding loans which are guaranteed by the state. Before coming into force of the state guarantees (guarantee case) transactions related to state-guaranteed debt don’t affect the state budget.

In order to ensure full or partial fulfillment of debt obligationsof Ukrainian resident business entities, state guaranteesmay be provided by a decision of the Cabinet of Ministers of Ukraine or on the basis of international agreements solely within the limits and by the directions specified in the State Budget Law of Ukraine. Upon the decision of the Cabinet of Ministers of Ukraine, the relevant deeds on its decisions are made by the Minister of Finance of Ukraine.

State guarantees are provided on the terms of payment, maturity, and property security in a manner prescribed by law.

State guarantees are not provided to secure debt obligations of economic entities if the direct source of repayment of loans is foreseen by the state budget (except for the debt obligations arising from loans provided by international financial organizations).

Payments related to the performance of state guarantees in the guarantee event are carried out in accordance with the relevant agreements, regardless the amount of funding determined for this purpose in the State Budget Law of Ukraine, and are reflected as crediting from the budget to economic entities with the guaranteed liabilities. State and state-guaranteed debt don't include debts of local authorities and the state enterprises, liabilities of which are not guaranteed by the state.

The limit of state and state-guaranteed debt, the limit of state guarantees are determined for each budget period by the State Budget Law of Ukraine.

The amount of state debt and state-guaranteed debt is calculated in a monetary form as the outstanding nominal amount of debt liabilities. Data on state and state-guaranteed debt is determined in national currency (UAH) and U.S. dollars at the official exchange rate of the National Bank of Ukraine on the last day of reporting period and include transactions dated that day.

According to the Budget Code of Ukraine, the total amount of state debt and state-guaranteed debt at the end of the budget period cannot exceed 60 percent of the annual nominal gross domestic product of Ukraine. This provision does not apply in the cases of the introduction of a martial law in Ukraine, a state of emergency or carrying out an anti-terrorist operation on the territory of Ukraine.

More information is available in the sections:

"State Debt and State-Guaranteed Debt", "Regulations", "Domestic Bonds", "Eurobonds", "Primary Dealers" and "Credit Ratings".

Also, data on state debt and state-guaranteed debt statistics can be found in the section "Debt Statistics".