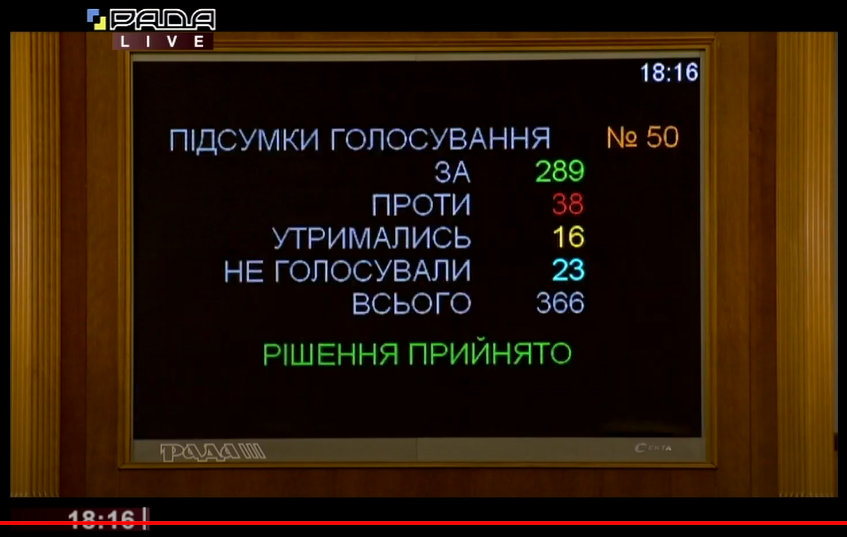

The Parliament of Ukraine Approved the Draft State Budget for 2021

-

About Ministry

- Recruitment

-

Accountable agencies

-

State Enterprises and Institutions Belonging to the Sphere of Management of the Ministry

- State enterprise "Management for the operation of the property complex"

- SERVICE AND PUBLISHING CENTR

- Central Treasury sample control enterprise

- Eastern state-owned enterprise of sampling control

- Western state-owned enterprise screening control

- Southern state enterprise of sampling control

- Dnipropetrovsk state-owned enterprise of sampling control

- State enterprise Kyiv offset factory

- State Service for Financial Monitoring

- State Treasury

- The State Audit Service of Ukraine

- State Tax Service of Ukraine

- State Customs Service of Ukraine

- Personnel Audit Procedures of State Customs Service

- State Tax University

-

State Enterprises and Institutions Belonging to the Sphere of Management of the Ministry

- Minfin Panel

-

Policy Issues

- Budget policy

- Tax Policy

-

Customs Policy

-

Integration of customs legislation into EU law

- Direct and indirect customs representation: possible scenarios for declaring goods and the role of a customs broker

- Customs representative and customs holder: who submits and signs documents

- Confirmation of the reliability of credentials for obtaining authorizations

- Authorization to carry out customs brokerage activities

- Integration of customs IT systems to MASP-C

-

Integration of customs legislation into EU law

-

Accounting and Auditing

-

Accounting

-

Introduction of International Financial Reporting Standards

- Translation of International Financial Reporting Standards 2025 (to be completed)

- Translation of international financial reporting standards of 2024

- Translation of international financial reporting standards of 2023

- Archive of translations

- Taxonomy

- Translation of technical publications

- General Clarifications (filled in after the preparation of the relevant letters of explanation)

- Accounting in Private Sector

- Accounting in the Public Sector

- Methodological Accounting Council under the Ministry of Finance of Ukraine (download a short description)

- IFRS Council under the Ministry of Finance of Ukraine (download a short description)

-

Introduction of International Financial Reporting Standards

- Auditing

- Sustainability reporting

-

Accounting

-

Debt policy

- Overview

- Debt News

- Debt Statistics

- Domestic Bonds

- Primary Dealers

- Eurobonds

- Credit Rating

- Investor Relations

- DMO Awards

- Anti-money laundering policy (AML)

- Financial Policy

- National revenue strategy

-

International Cooperation

-

Partners

- EU

- International Monetary Fund

-

Cooperation in Attracting Financing from the International Financial Institutions

- Development Bank of the Council of Europe

- Procedure for attracting funds of International Financial Institutions

- World Bank

- EBRD

- EIB

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH

- KFW

- Register of Joint IFIs Projects at the Stage of Preparation and Implementation (information)

- International Technical Assistance (within the competence of the Ministry of Finance)

- Monitoring of international technical assistance projects

- Cooperation with the Development Partners

- Ukraine Donor Platform

-

Partners

- International Tax Relations

- Development of Public Internal Financial Control (PIFC)

-

Public investment management

- Regulatory documents

- Implementation of the roadmap for reforming the management of public investments

- Interdepartmental Commission on the Distribution of Public Investments

- Unified portfolio of public investment projects (list of priority public investment projects)

- Interdepartmental working group on reforming the public investment management system

- Reference information

-

Other Areas of Public Policy

- Internal Audit

- Audit Committee of the Ministry of Finance of Ukraine

- Scientific and scientific and technical activity

- Reform Support Team at the Ministry of Finance of Ukraine

- Verification of State Social Payments

-

Fiscal Risks Managament

- Clarifications

- Legislation on Fiscal Risks Management

- List of Economic Entities with which Major Fiscal Risks May Be Related

- Reports

- List of business entities to which the Ministry of Finance approves proposals for individual financial indicators for the planning period, as well as proposals for maximum thresholds for the volume of capital investments

- Operations with precious stones and metals

- Licensing

- Public Finance Management Strategy (PFMS)

- Strategic Plan

-

Key Spending Unit - Ministry of Finance

- Budget Requests

- Passports of Budget Programs

- Evaluation of the Effectiveness of Budget Programs

- Procurement Reports

- Reports on the implementation of public investment projects

- Budget Information

- Information on the effectiveness of the use of public funds

- The structure and volume of budget funds under budget programs

- Cash Management

- Programs

-

Legislation

-

Regulatory Activity

- Regulatory Performance Tracking Reports 2026

- Activity plan of the Ministry of Finance of Ukraine for the preparation of draft regulatory acts in 2026.

- Schedule of measures in 2026 to track the effectiveness of regulatory acts of the Ministry of Finance of Ukraine

- Reports on tracking the effectiveness of regulatory acts in 2025.

- Activity plan of the Ministry of Finance of Ukraine for project preparation regulatory acts in 2025

- Plan-schedule of implementation of measures in 2025 regarding performance tracking regulatory acts of the Ministry of Finance of Ukraine

- reports_on_the_effectiveness_of_regulatory_acts_2024

- The activity plan for the preparation of the regulatory acts draft 2024

- Schedule of measures to monitor the effectiveness of regulatory acts 2024

- reports_on_the_effectiveness_of_regulatory_acts_2023

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2023

- Reports on the effectiveness of regulatory acts 2022

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2022

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2021

- Schedule of measures to monitor the effectiveness of regulatory acts 2021

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2020

- Schedule of measures to monitor the effectiveness of regulatory acts 2020

- Reports on the effectiveness of regulatory acts 2019

- The activity plan for the preparation of the regulatory acts draft 2019

- Schedule of measures to monitor the effectiveness of regulatory acts 2019

- Reports on the effectiveness of regulatory acts 2018

- The activity plan for the preparation of the regulatory acts draft 2018

- Schedule of measures to monitor the effectiveness of regulatory acts 2018

- Reports on the effectiveness of regulatory acts 2017

- The activity plan for the preparation of the regulatory acts draft 2017

- Schedule of measures to monitor the effectiveness of regulatory acts 2017

- Reports on the effectiveness of regulatory acts 2016

- The activity plan for the preparation of the regulatory acts draft 2016

- Schedule of measures to monitor the effectiveness of regulatory acts 2016

- Reports on the effectiveness of regulatory acts 2015

- The activity plan for the preparation of the regulatory acts draft 2015

-

Draft Regulatory Acts Discussion

- Draft regulatory acts for discussion in 2026

- Draft regulatory acts for discussion in 2025.

- Regulatory acts draft for discussion 2024

- Regulatory acts draft for discussion 2023

- Regulatory acts draft for discussion 2022

- Regulatory acts draft for discussion 2021

- Regulatory acts draft for discussion 2020

- Regulatory acts draft for discussion 2019

- Regulatory acts draft for discussion 2018

- Regulatory acts draft for discussion 2017

- Regulatory acts draft for discussion 2016

- Regulatory acts draft for discussion 2015

-

Draft Legislation

- Draft regulatory legal acts in 2026

- Draft normative legal acts in 2025.

- Legal acts drafts 2024

- Legal acts drafts 2023

- Legal acts drafts 2022

- Legal acts drafts 2021

- Legal acts drafts 2020

- Legal acts drafts 2019

- Legal acts drafts 2018

- Legal acts drafts 2017

- Legal acts drafts 2016

- Legal acts drafts 2015

-

Regulatory Activity

-

Data

- Cooperation with Civil Society

- Press Center

On December 15, 2020 the Parliament of Ukraine approved the draft Law "On the State Budget of Ukraine for 2021" in the second reading and as a whole.

“This year, the preparation of the state budget for 2021 by the Ministry of Finance took place in a fundamentally different economic situation in Ukraine and the world. The starting positions were the budget deficit of 7.5% of GDP, underperformance of the revenue annual plan of UAH 44 billion, the outbreak of the pandemic and the coronavirus crisis. When finalizing the document for the second reading, it was important for us to preserve the priorities defined by the President and the Government, which were supported by MPs, and at the same time to reduce the state budget deficit, following the principles of balance and feasibility," noted the Minister of Finance, Sergii Marchenko.

The Ministry of Finance has carefully considered about 2.5 thousand amendments of MPs. The Ministry of Finance has taken into account the majority of proposals submitted by the parliamentarians, taking into consideration expenditure priorities and possibilities of the revenue part of the budget. In total, the Budget Conclusions take into account parliamentary initiatives of UAH 14 billion.

The budget deficit of the general government sector to GDP was reduced from 5.8% to 5.24 %, while the state budget deficit - from 6% to 5.5% and amounts to UAH 246.6 billion. The difference between the first and second readings is UAH 23.7 billion.

It should be noted, that the State Budget for 2020 provided a deficit of 7.5% - this figure was reduced by 2% (by UAH 52 billion).

In addition, a gradual reduction of the budget deficit is planned in the medium term perspective: 4.5% of GDP - in 2022 and 3.5% of GDP - in 2023.

"We continue to move within the IMF program: the budget-2021 parameters coincide with the estimates of the Fund's experts. We have maintained the trust and support of international partners. Evidence of this is the EUR 600 million of macro-financial assistance from the EU. Recently, we have signed the agreement with the IBRD for USD 300 million to finance measures to overcome the pandemic. Also, we have announced the pricing of another public Eurobond transaction. The implied yield of 6.20% is the lowest yield in the history of Ukraine’s public USD Eurobond offerings! The demand of foreign investors for Ukrainian domestic government bonds is also returning,” Sergii Marchenko stressed.

According to him, this indicates that the country is following the chosen course of maintaining financial stability and economic growth.

"We proved this when we accumulated the necessary funds in the spring under critical conditions and were able to respond to Covid-challenges, and make up the budget revenue gap in six months," the Minister of Finance noted.

It should be recalled that due to the optimization and improving the efficiency of the State Tax Service, improvement of tax administration and the elimination of VAT fraud schemes, the gap in budget revenues of UAH 44 billion has been completely closed. Currently, the State Tax Service has already fulfilled ahead of schedule and even overperformed the annual plan for state budget revenues by 10%.

In comparison with the first reading, the revenues of the draft state budget for 2021 are increased by UAH 20.9 billion and are projected at UAH 1,092 billion. These are the real funds that the state plans to receive next year without raising taxes or any pressure on the business.

The expenditures of the state budget are envisaged at UAH 1,328 billion, which takes into account the need to finance all the priority needs of the state, in particular:

o healthcare;

o purchase of vaccines from COVID-19;

o an increase in the minimum wage;

o indexation of pensions and benefit payments for pensioners aged 75+;

o raising the salaries of doctors by 30% and teachers by 25%;

o development of quality education;

o decent support to the sphere of culture, sports and digitalization;

o development of the Program "Affordable Loans 5-7-9%" and portfolio guarantees;

o support for agriculture and regional development.

"Balanced budget expenditures are the guarantee of the state's fair treatment to each of its citizens. Every hryvnia of taxpayers will be used effectively and for its intended purpose," emphasized Sergii Marchenko.